Majority of production by independent suppliers

As a company with international production activities and business operations, HUGO BOSS relies on well-rehearsed, standardized and system-enabled sourcing and production processes as a key success factor. This is the only way to ensure the timely availability of goods on the shop floor and the outstanding quality that customers of HUGO BOSS products are accustomed to. 20% of the total assortment of products is manufactured by HUGO BOSS' own factories (2012: 20%), 80% of the assortment is manufactured by independent contract suppliers or sourced as merchandise (2012: 80%). As the Group produces a substantial part of its classic tailoring range in-house, it has and continually expands critical know-how and optimizes quality standards and the availability of goods.

In-house production facilities are located in Izmir (Turkey), the Group's largest production facility, Cleveland (USA), Metzingen (Germany), Radom (Poland) and Morrovalle (Italy). The Izmir plant mainly produces suits, trousers, jackets, shirts and classic womenswear. At its Cleveland factory, HUGO BOSS produces suits for the American market. Apart from prototypes, sample pieces and individual orders, the Metzingen site mainly produces suits, jackets and trousers in small series. This is also where HUGO BOSS tailors its Made to Measure suits. Production activities in Radom and Morrovalle focus on making shoes.

Strategic management of the supplier network as a success factor

Given its broad spectrum of apparel and accessories for the premium and luxury segment, HUGO BOSS draws on an adequately sized network of specialist suppliers. Through the optimal use of capacity it was possible to concentrate the sourcing volume on a reduced number of suppliers in the past year. In the areas of merchandise and contract manufacturing, for instance, the Group partnered with less than 300 suppliers in 2013 (2012: 320). The sourcing volume is generally distributed among a global network of suppliers in order to spread risk and maintain the greatest possible independence from individual sourcing regions and producers. Indeed, the largest single independent supplier only made up 7% of the total volume sourced by the HUGO BOSS Group (2012: 8%). Report on Risks and Opportunities

Sourcing modes depend on product groups

Sourcing activities break down into the procurement of raw materials, contract manufacturing and purchased merchandise. The raw materials sourced are mainly fabrics but also include additional items such as lining, buttons, thread or zippers. The majority of raw materials processed in-house or under contract comes from Europe. Fabrics are preferably sourced from long-standing fabric suppliers in Italy.

It is primarily suits, jackets and trousers that are made under contract manufacturing arrangements. In these product groups, HUGO BOSS mainly works with companies in Eastern Europe. For products made under contract manufacturing, the supplier is provided with the requisite patterns as well as the fabrics and other components. By contrast, sourcing in the area of sportswear has a greater focus on merchandise, which is mostly sourced from Asia and Eastern Europe. With this kind of sourcing, suppliers get patterns from HUGO BOSS as necessary but independently source their raw materials. With the exception of the classic shoe collection that is produced at the Company's own factories in Italy and Poland, the product category shoes and leather accessories is mainly sourced from business partners in Asia and Europe.

Eastern Europe remains most important sourcing region

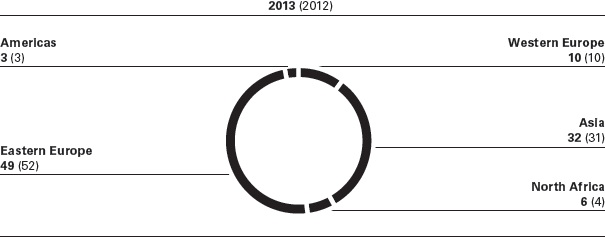

Measured by value, almost half of all HUGO BOSS products are produced in Eastern Europe and Turkey (49%; 2012: 52%). The Company's own factory in Turkey plays a leading role in this context, making up 15% of the total volume sourced (2012: 15%). Asia is the source of 32% of products (2012: 31%). China is still the most important supplier country in this region. The remaining goods stem from Western Europe (10%; 2012: 10%), North Africa (6%; 2012: 4%) and the Americas (3%; 2012: 3%).

Regional split of sourcing and production volume (in %)