Statement of cash flows

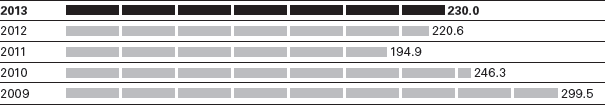

Free cash flow (in EUR million)

The statement of cash flows is presented in accordance with IAS 7. The cash and cash equivalents reported here correspond to the line item of that name in the statement of financial position.

Cash inflow from operating activities up on prior-year period

At EUR 416 million cash inflow from operating activities was up on the prior-year level (2012: EUR 392 million). The development was essentially attributable to the higher consolidated net income. Lower cash outflow from changes in trade receivables and higher cash inflow from changes in trade payables also had a positive effect. The cash outflow of EUR 36 million resulting from the change in inventories (2012: cash inflow of EUR 23 million) led to an overall cash outflow from trade net working capital of EUR 45 million (2012: EUR 16 million).

The net cash outflow from interest expenses and income decreased to EUR 8 million as of the reporting date (2012: EUR 16 million). The lower amount of debt following the refinancing and the lower market interest rates had a positive effect.

As cash flow is presented after currency adjustments, these figures cannot be derived from the statement of financial position.

Expansion of the Group's own retail business causes increase in cash outflow from investing activities

At EUR 186 million cash outflow from investing activities was up on the prior-year level (2012: EUR 172 million). This development was mainly driven by increased capital expenditure on property, plant and equipment in the course of expanding the Group's own retail business. A cash outflow of EUR 12 million is attributable to property, plant and equipment and intangible assets acquired in business combinations in fiscal year 2013. Notes to the consolidated financial statements, Business combinations

Free cash flow, measured as the cash inflow from operating activities and the cash outflow from investing activities, increased by EUR 9 million to EUR 230 million in the reporting year (2012: EUR 221 million).

Cash outflow from financing activities shaped by refinancing

Cash outflow from financing activities totaled EUR 363 million in fiscal year 2013 (2012: EUR 166 million). Apart from the dividend distribution of EUR 215 million (2012: EUR 199 million), this was mainly marked by the repayment of the fixed tranche of the syndicated loan that was replaced in fiscal year 2013. The tranche of EUR 111 million drawn under the new syndicated loan agreement partially compensated for the cash outflow.

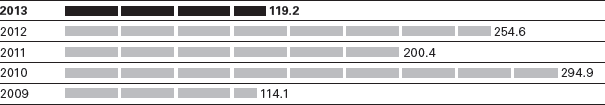

Cash and cash equivalents as of December 31 (in EUR million)

Cash and cash equivalents decreased to EUR 119 million as of the reporting date (December 31, 2012: EUR 255 million). This development was essentially attributable to the repayment of liabilities due to banks.