Financial management and financing principles

Financial management and financing principles

The most important goal of financial management at HUGO BOSS is to secure sufficient liquidity reserves, while minimizing financial expenses in the Group. Accordingly, the aim is to ensure that the Group can meet its payment obligations at all times and that it has sufficient liquidity to grow its business. Report on risks and opportunities, Financing and liquidity risks

Central bundling of global financial management

Group-wide liquidity management and monitoring of financial risks are bundled at the central treasury department of HUGO BOSS AG. Global financial management is based on Group-wide principles and guidelines. At the level of the subsidiaries, the finance managers are responsible for compliance with treasury guidelines.

The HUGO BOSS Group's external financing volume is essentially drawn thorough HUGO BOSS International B.V. This covers most of the financing requirements of the Group's entities. Only in individual cases do HUGO BOSS companies directly obtain debt capital, for instance, if it is economically advantageous to use local credit and capital markets. If the Group companies directly enter into external loan transactions, HUGO BOSS AG or HUGO BOSS International B.V. issue guarantees or letters of comfort as required in each case.

The cash inflow from the operating activities of each Group company is the Group's most important source of liquidity. The liquidity forecast is based on a three-year financial planning and a supplementary liquidity planning on a rolling basis with a one-year planning horizon that is prepared by all Group companies using a central financial reporting system. This allows the HUGO BOSS Group to continuously monitor its financial position and the future development of liquid funds and to intervene if necessary.

Daily liquidity management uses efficient cash management systems to channel liquidity surpluses of individual Group companies to other companies with financial requirements (cash pooling). This intercompany financial balancing system reduces external financial requirements and optimizes net interest expenses.

Financing

Market capacity, cost of financing, investor diversification, flexibility, covenants and terms to maturity are taken into account when selecting financial instruments. Notes to the consolidated financial statements, Note 26 and Note 29

Syndicated loan secures long-term financial flexibility

The Group secured its financial flexibility in the long term by refinancing the syndicated credit facility that expired in May 2013. The syndicate of banks led by DZ Bank, Landesbank Baden-Württemberg and Unicredit AG granted a new syndicated loan with a volume of EUR 450 million. This comprises a fixed tranche amounting to EUR 100 million and a revolving tranche of EUR 350 million. Apart from the fixed tranche, an amount of EUR 11 million had been drawn from the revolving tranche as of the reporting date.

In its capacity as “in-house bank”, HUGO BOSS International B.V. provides these funds to Group companies with increased financing needs in the form of intercompany loans. These loans are issued in the local currency of each respective distribution company and, for the most part, take the form of an overdraft facility. In order to hedge against the currency risk exposure of HUGO BOSS International B.V., forward exchange contracts were concluded for the main currencies. In addition, subbranches of the revolving tranche permit amounts to be borrowed in U.S. dollars and pounds sterling. The Group has additional liquidity secured in the form of bilateral lines of credit with a total volume of EUR 111 million. Of this amount, EUR 69 million had been drawn as of December 31, 2013. Apart from the undrawn amounts from the lines of credit amounting to EUR 382 million, the Group has access to liquidity funds of EUR 119 million as of the reporting date, of which EUR 25 million is kept in time deposits with a term of up to three months.

Financing conditions

The syndicated loan agreement contains a standard covenant requiring the maintenance of total leverage, defined as the ratio of net financial liabilities to EBITDA before special items. Notes to the consolidated financial statements, Note 26

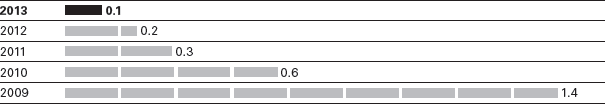

Total leverage as of december 311

1 Net financial liabilities/EBITDA before special items.

Further improvement of financial strength

As in prior fiscal years, HUGO BOSS substantially exceeded the required minimum values as of December 31, 2013. Total leverage improved further year on year driven by the positive development of the operating result and the improvement in net financial liabilities. The ratio was down from 0.2 in the prior year to 0.1 as of the reporting date.

The financial liabilities of the HUGO BOSS Groups are mostly subject to variable interest rates and have short fixed-interest periods for the most part. Of the amount of financial liabilities subject to variable interest rates amounting to EUR 134 million, a volume of approximately EUR 112 million was hedged against an increase in interest rates using payer swaps as of December 31, 2013. There is no exposure to interest rate risks from the fixed-interest loans. Notes to the consolidated financial statements, Note 26

Off-Balance sheet Financial instruments

Financing is supplemented by operating lease agreements not reported in the statement of financial position relating to the Group's own retail locations as well as logistics and administration properties. Notes to the consolidated financial statements, Note 32