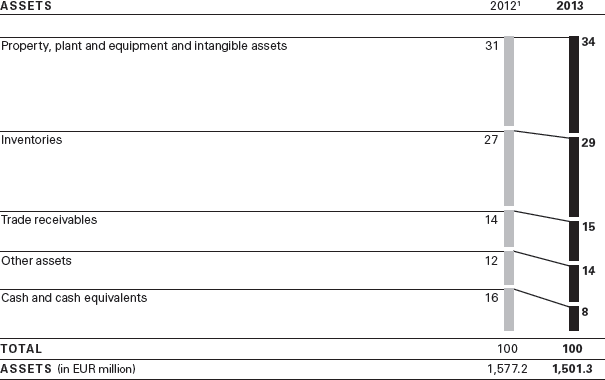

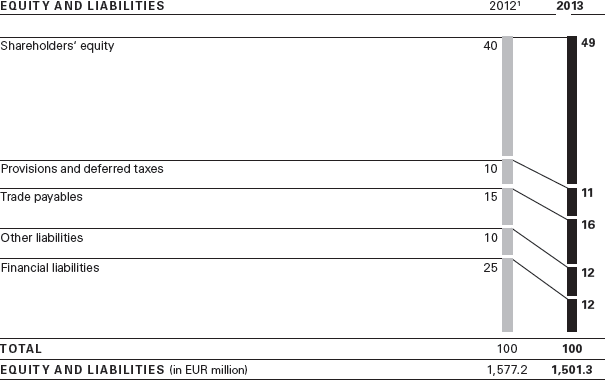

Structure of Consolidated Statement of financial position and key performance indicators

Deconsolidation of Distributionszentrum Vermietungsgesellschaft mbH & Co. Objekt HUGO BOSS Filderstadt KG

At the end of the first half of 2013, the entity Distributionszentrum Vermietungsgesellschaft mbH & Co. Objekt HUGO BOSS Filderstadt KG was deconsolidated due to the loss of control and has since then been carried as an investment under other non-current assets. This mainly affects the development of property, plant and equipment and intangible assets and financial liabilities. Notes to the consolidated financial statements, Note 5 // Basis of consolidation

Total assets decreased by 5% at the end of fiscal year 2013 to EUR 1,501 million (December 31, 2012: EUR 1,577 million). This was largely attributable to a decrease in liabilities due to banks. On the assets side of the statement of financial position, this was reflected in a decrease in cash and cash equivalents. This development more than compensated for the slightly higher balance of inventories and receivables compared to the end of the prior year.

Statement of financial position as of December 31 (in %)

1 Due to changes in accounting policies and corrections made, certain amounts shown here do not correspond to the figures reported in prior years (for more details see notes to the Consolidated Financial Statements, PDF: (PDF:) Changes in accounting policies/Corrections).

For absolute figures please refer to the statement of financial position

The share of current assets decreased compared to the prior year to 59% (December 31, 2012: 63%). The share of non-current assets increased accordingly from 37% in the prior year to 41% as of December 31, 2013. This development is mainly attributable to the lower amount of cash and cash equivalents as a result of the reduction in financial liabilities.

Statement of financial position as of December 31 (in %)

1 Due to changes in accounting policies and corrections made, certain amounts shown here do not correspond to the figures reported in prior years (for more details see notes to the Consolidated Financial Statements, PDF: (PDF:) Changes in accounting policies/Corrections).

For absolute figures please refer to the statement of financial position

On the equity and liabilities side, the share of financial liabilities decreased significantly from 25% in the prior year to 12% as of the reporting date. This development is attributable to the refinancing of the syndicated credit facility and a related reduction in the amount drawn from the credit facility. The equity ratio increased to 49% as of the reporting date (December 31, 2012: 40%).