Free float increases

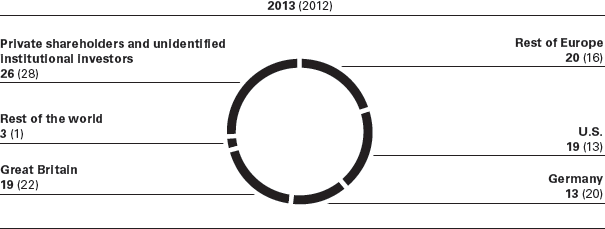

On May 3, 2013, the majority shareholder Red & Black Holding GmbH, an entity in which Permira Funds holds a majority shareholding, placed seven million HUGO BOSS shares on the market. Effective as of July 1, 2013, Red & Black Holding GmbH was merged into Red & Black Lux S.à r.l. which meant that the shareholder structure of HUGO BOSS AG as of December 31, 2013 was as follows: 55.62% of the shares are held by Red & Black Lux S.à r.l. (December 31, 2012: 65.56%, at that time trading as Red & Black Holding GmbH), 1.97% of the capital was held by HUGO BOSS AG as own shares (December 31, 2012: 1.97%). The remaining 42.41% of the shares are in free float (December 31, 2012: 32.47%).

Shareholder structure as of December 31 (in % of share capital)

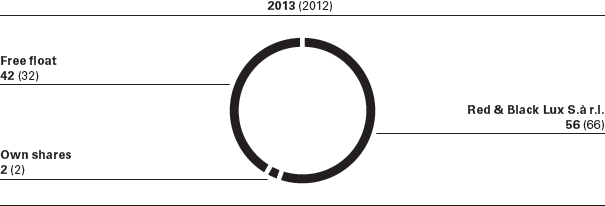

Investor base even more international

The ownership structure of the shares in free float was analyzed in 2013 with a view to addressing the institutional investors investing in HUGO BOSS in a more targeted manner. The result shows that HUGO BOSS’ investor base has become even more international. Indeed, the portion of shares held by German investors has decreased to 13% (2012: 20%). In contrast, the portion held by U.S. investors rose to 19% (2012: 13%). While the portion of shares held by institutional investors in Great Britain decreased to 19% (2012: 22%), the weighting of other European countries in the shareholder structure rose to 20% (2012: 16%). Private shareholders enlisted in the share register and institutional investors on which the Company does not have any further details make up 26% of the free float (2012: 28%).

Regional split of investor base as of December 31 (in % of free float)