Notes to the Income Statement

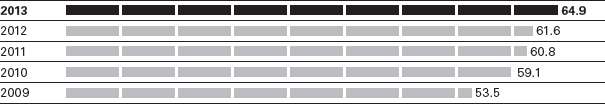

Gross profit margin (in %)

Gross profit margin increased to 64.9%

In fiscal year 2013, it was possible to ratchet up the gross profit margin by 330 basis points to 64.9% (2012: 61.6%). This positive development is mainly due to the expansion of the Group's own retail business, lower discounts in the Group's own retail business as well as due to positive effects from the improved inventory situation. At EUR 1,580 million, the gross profit in 2013 was up 9% year on year (2012: EUR 1,444 million).

Expansion of the Group's own retail business led to higher selling expenses

Selling and distribution expenses in fiscal year 2013 totaled EUR 892 million, up 13% year on year (2012: EUR 792 million). Relative to sales, selling and distribution expenses increased from 34% to 37%. Particularly due to the global expansion of the Group's own retail business, selling expenses increased in the reporting year by 19% compared to the prior year. This includes additional expenses for the net increase of 170 locations, which were opened or taken over in the course of the global expansion of this sales channel in fiscal year 2013. Marketing expenses increased by 1% year on year. Relative to sales, logistic expenses decreased from 3% in the prior year to a current 2%. Bad debt allowances were again immaterial in the reporting period on account of the strict receivables management. Notes to the consolidated financial statements, Note 3

Stable administration expenses in relation to sales

Administration expenses in fiscal year 2013 totaled EUR 229 million, up 6% year on year (2012: EUR 216 million). Relative to sales, administration expenses remained at the prior-year level of 9%. General administration expenses increased by 7% to EUR 170 million (2012: EUR 159 million). Relative to sales, research and development costs incurred creating fashion collections remained at the prior-year level of 2%, while increasing in absolute terms by 4% year on year to EUR 59 million (2012: EUR 57 million). Notes to the consolidated financial statements, Note 4

Other operating expenses net of other operating income came to EUR -3 million (2012: EUR -4 million); this was a result of special items, mainly related to organizational changes in Europe. Notes to the consolidated financial statements, Note 5

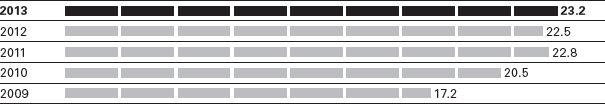

Adjusted EBITDA margin (in %)

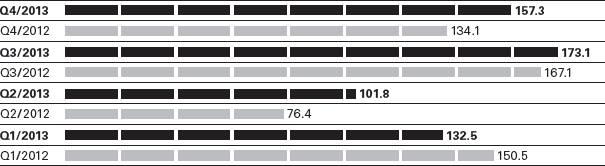

EBITDA before special items by quarter (in EUR million)

Adjusted EBITDA margin climbs to 23.2%

The key internal performance indicator EBITDA before special items increased year on year by 7% to EUR 565 million (2012: EUR 528 million). At 23.2%, the adjusted EBITDA margin was 70 basis points above the prior-year figure (2012: 22.5%)

At EUR 105 million, depreciation and amortization were 14% up on the prior-year figure (2012: EUR 92 million). This was primarily due to the relative increase in property, plant and equipment and intangible assets compared to total assets as a result of investment in the Group's own retail business. Notes to the consolidated financial statements, Note 11 and Note 12

EBIT came to EUR 456 million at the end of fiscal year 2013, up 6% year on year (2012: EUR 432 million). Higher selling expenses were partially offset by the increase in gross profit.

The financial result, measured as the net expense after aggregating the interest result and other financial items, decreased by EUR 1 million to EUR 23 million in fiscal year 2013 (2012: EUR 24 million). On account of the lower amount of debt following refinancing measures and a lower interest level, the net interest expense decreased by 20% to EUR 14 million (2012: EUR 18 million). Other financial items came to a net expense of EUR 8 million and, mainly due to negative exchange rate effects, were up EUR 2 million on the prior-year period (2012: net expense of EUR 6 million). Notes to the consolidated financial statements, Note 6

At EUR 433 million, earnings before taxes were up 6% year on year (2012: EUR 408 million). At 23%, the Group's income tax rate was down one percentage point below the prior-year level (2012: 24%). A regional shift in the share of earnings of domestic and foreign entities of the HUGO BOSS Group, coupled with marginally lower corporate tax rates at an international level, led to a decrease in the Group's effective tax rate.

Net income increases by 7%

Net income totaled EUR 333 million in the past fiscal year, up 7% year on year (2012: EUR 311 million). The net income attributable to equity holders of the parent company also increased by 7% to EUR 329 million (2012: EUR 307 million). As in the prior year, net income attributable to non-controlling interests came to EUR 4 million (2012: EUR 4 million) and mainly relates to the 40% investment held by the Rainbow Group in the “joint venture” entities in China.

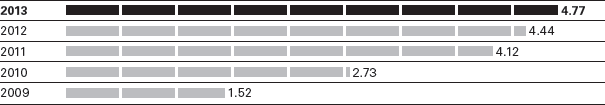

Earnings per share (in EUR)

Earnings per share improved year on year by 7% to EUR 4.77 (2012: EUR 4.44).